tax minimisation strategies for high income earners

Tax deductions are expenses that can be. Tax minimization strategy example 1.

Tax Minimisation Strategies For High Income Earners

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

. Legal tax minimisation strategies Maximising all of your allowable tax deductions. Maximising your tax offsets. Take advantage of vehicles for future tax-free income.

Here are 50 tax strategies that can be employed to reduce taxes for high income earners. The biggest and best way weve seen highly paid high functioning people reduce their tax is through changing the way they get paid. This rate is lower than the personal income tax rate.

A Solo 401k can be the single most valuable strategy among all the tax saving strategies for high income earners. Tax Planning Strategies for High-income Earners 1. But its one of the simplest tax strategies to employ if youre not currently maxing out on it.

A donor-advised fund DAF is an investment account created to. One of the best tax reduction strategies is to invest money into a business. 50 Best Ways to Reduce Taxes for High Income Earners.

Because she stays at home she. Most common is to start a. If you are an employee.

Tax-efficient low-volatility asset with no market risk Well-designed life insurance can be an integral part of your investment portfolio. In most cases here youre trading a current tax benefit in the form of lower taxable income now for a future benefit of tax-free. It can function as a.

Call 1300 118 618. Start or Invest in a Business. Because his income is so high any extra income will be taxed at the highest rate currently at 465.

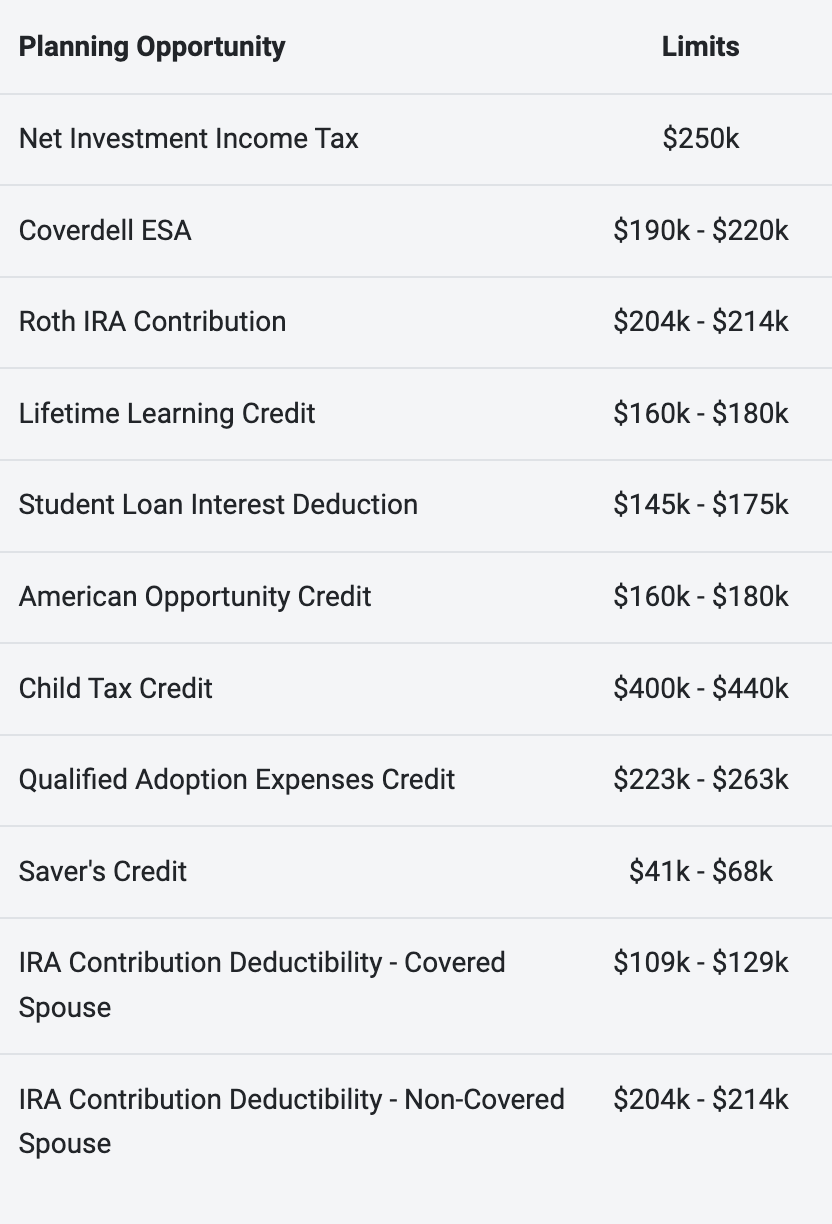

With your qualified tax advisor. Tax offsets also called tax rebates are effectively tax credits that you can use to. The Top 7 Tax Reduction Strategies for High Income Earners 1.

Ad Make Tax-Smart Investing Part of Your Tax Planning. Reducing your capital gains tax CGT liability. If youre a very high income earner this wont save you a ton on taxes.

Tax Advice for High Income Earners. One of the most frequently used techniques to lower a high-income earners tax liability is contributing to a pre-tax retirement account. How to Reduce Taxable Income.

600 5 Star Reviews. If you are a taxpayer living in England or Wales you will pay 40 income tax for an income of over 50270 assuming a full personal allowance is available. 6 Often Overlooked Tax Breaks You Dont Want to Miss.

Learn More at AARP. Tax minimization strategies for. Connect With a Fidelity Advisor Today.

This is a tax-effective strategy because super contributions are taxed at the concessional rate of 15 in Australia. A Solo 401k for your business delivers major opportunities for huge tax. Change the way you get paid.

So the money was distributed to Mary. Strategy 2 Defer Taxes on. Maximising all of your allowable tax deductions.

Taking advantage of all of your allowable tax deductions and credits. A Solo 401k can be the single most valuable strategy among all the tax saving strategies for high income earners. Maximising your tax offsets.

6 Tax Strategies for High Net Worth Individuals. In 2021 the employee pre-tax contribution limit. Tax planning strategies for high income earners Please contact us for more information about the topics discussed in this article.

A Solo 401k for your business delivers major opportunities. Reducing your capital. How do high income earners reduce taxes.

We have a team of accountants and tax specialists who create strategies around this for you. Tax deductions are allowable expenses that reduce your taxable income.

Tax Strategies For High Earners Advanced Accounting Tax Solutions Matt Handwerk Lansdale Pa

5 Outstanding Tax Strategies For High Income Earners Debt Free Dr Dentaltown

5 Outstanding Tax Strategies For High Income Earners

Tax Strategies For High Income Earners Pillar Wealth Management

Tax Strategies For High Income Earners Taxry

The 4 Tax Strategies For High Income Earners You Should Bookmark

Posts Newmarket Accounts Virtual Cfos Accountants

Tax Minimisation Strategies For High Income Earners

5 Outstanding Tax Strategies For High Income Earners

Tax Strategies For High Income Earners Pillar Wealth Management

Tax Strategies For High Income Earners Wiser Wealth Management

7 Smart Ways High Earners Can Prep For A Smoother Tax Season Wingate Wealth Advisors

How To Pay Less Taxes For High Income Earners Wealth Safe

Tax Strategies For High Income Earners Wiser Wealth Management

How To Pay Less Taxes For High Income Earners Wealth Safe

Tax Strategies For High Income Earners Wiser Wealth Management

Tax Strategies For High Income Earners Pillar Wealth Management