does nevada tax your retirement

Since Nevada does not have a state income tax any income you receive during retirement will not be taxed at the state levelThis includes income from both Social Security and retirement accounts. With no income tax theres also no tax on 401k or IRA distributions.

7 States That Do Not Tax Retirement Income

This is not a legal.

. It is a tax-friendly state for retirees in Alabama. There are no individual income taxes in Nevada. Retirees in Nevada are always winners when it comes to state income taxes.

Your after tax contribution is refundable upon the termination of your employment if you do not. You can withdraw any amount from retirement accounts taxation-free. Nevada New Hampshire South Dakota Tennessee Texas Washington Wyoming States That Wont Tax Your 401 k IRA or Pension Distributions The following states are exempt from income taxes on 401k IRA annuity and pension income.

Distributions received from the Thrift Savings Plan TSP are not taxed. The Silver State wont tax your pension incomeor any of your other income for that matter because it doesnt have an income tax. Nevada does not tax retirees accounts or pensions.

Nevada sales tax is less than in California. 800-742-7474 or Nebraska Tax Department. Starting in 2022 all military retirees may exclude 50 percent of their military retirement benefits.

By simulating a move to Nevada from California we find that Bob and Jane save over 156000 in taxes throughout their retirement. Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming. One reason is that the state doesnt tax private or government pension income as long as it isnt for early retirement that is before age 59½.

Wages capital gains inheritances and yes winnings are all devoid of state income taxes. Whether youre a teacher a real estate mogul or a professional card shark if you live in Nevada you wont need to pay any state taxes on your earnings. Additionally the average effective property tax rate in Nevada is just 053.

The more money you have to withdraw in retirement the more potential you have to save on your tax bill. It is based on retirement law effective from the 75th session of the Nevada Legislature 2009. New Hampshire dividend and interest taxes only South Dakota.

A lack of tax Nine of those states that dont tax retirement plan income simply because distributions from retirement plans are considered income and these nine states have no state income taxes at all. Furthermore below you can see a year-by-year breakdown of Bob and Janes estimated taxes. Taxes on Social Security income are not imposed.

What Taxes Do Retirees Pay In Alabama. Thus we crunched the numbers and present a concise yet thorough analysis. The same goes for.

At 83 Total tax burden in Nevada is 43rd highest in the US. Nevada has no income tax. Thats because Nevada has no state income tax of any kind.

As a percent of value property tax paid is 84. Arizona exempts Social Security and some pensions from taxation. Illinois Mississippi and Pennsylvania States That Wont Tax Your Pension But Taxes 401 ks and IRAs.

To receive the maximum benefit you will need to wait until you have reached your own full retirement age. Of course you must still pay federal income taxes. This is the list of the 37 states that will not impose a tax on your Social Security retirement income.

Nevada has no state income tax or inheritance tax making it the ideal state for someone who has a high income in retirement or a substantial 401k or IRA that they will be forced to distribute at 705. What taxes do retirees pay in Nevada. Learn more about Nevada Income Taxes.

Social Security and Retirement Exemptions. This is enough to get them a little over one extra year of income. Public Employees Retirement System of Nevada to provide general information.

Does Nevada tax your pension. They are not taxed. State sales tax is 685 but localities can increase that to 81.

The following states dont require military members to pay state income tax on military retirement pay because there is simply no state income tax collected. If you have wages in your state your rate may be low 5 high 50 or both. Marginal Income Tax Rates.

52 rows Tax info. Someone who withdraws 15 million per year could save 133 by moving from California to a state without an income tax like Wyoming. Tennessee dividend and interest taxes only but will be phased out in 2021 Texas.

Although the Last Frontier has no state income or sales tax it isnt necessarily a tax haven for all retirees. Theres no inheritance gift or estate tax. The state ranked 28th highest for property tax collections in 2020.

401 ks and IRAs. The state of Nevada has no income tax at all which is why pensions social security and even 401ks are all safe and exempt from tax. Military retirees can elect either a 40 percent exclusion of military retirement income for seven consecutive tax years or a 15 percent exclusion for all tax years beginning at age 67.

High property taxes have a. For many people who are considering a financially-based move from California to Nevada an adequate understanding of how tax structures can affect them is important to their decision-making. Your benefits are unaffected should your former spouse elect to take Social Security before reaching full retirement age or if your ex-spouse starts a new family.

Here Are The 10 Best Cities In Nevada To Retire In Best Cities Nevada Small Towns

States That Don T Tax Military Retirement Pay Military Benefits Military Retirement Military Retirement Pay Military Benefits

Deciding Where To Retire Finding A Tax Friendly State To Call Home Business Wire

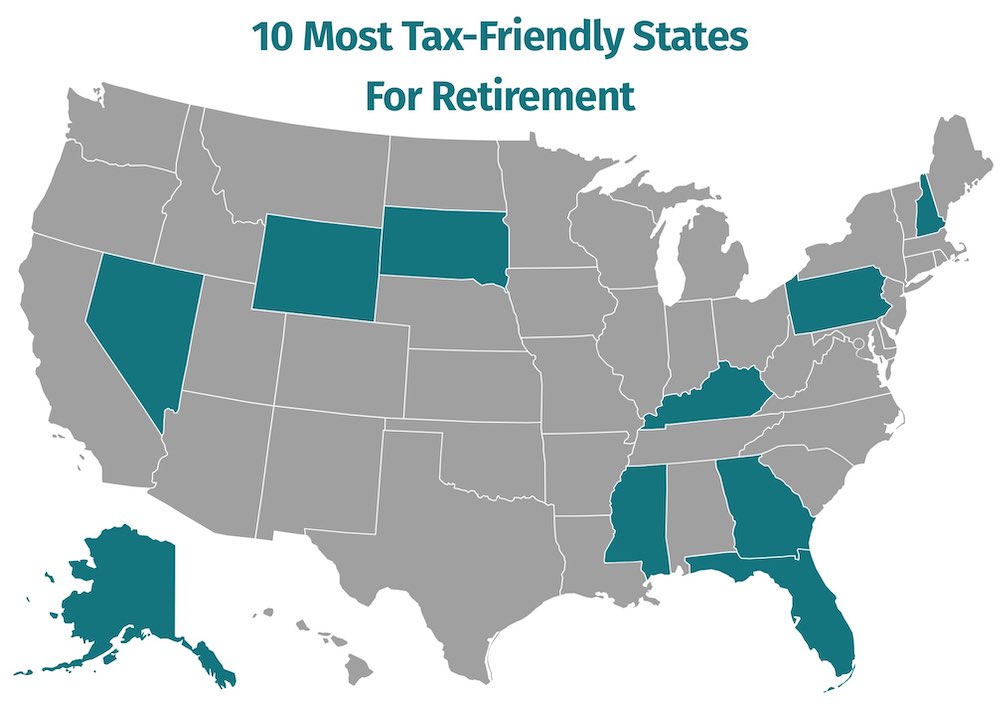

10 Most Tax Friendly States For Retirees Retirement Advice Retirement Tax

Which States Pay The Highest Taxes Business Tax Family Money Saving Economy Infographic

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Retirement Income Best Places To Retire Retirement Locations

Using A Ning Trust To Reduce State Income Taxes Income Tax Income Grantor Trust

Nevada State Line A Debt Free State Welcomes You Debt Free Free State Nevada State

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

Tax Friendly States For Retirees Best Places To Pay The Least

Monday Map State Local Property Tax Collections Per Capita Teaching Government Property Tax Map

Top 10 Most Tax Friendly States For Retirement 2021

Pin On Social Security Disability

Which States Have The Lowest Property Taxes Property Tax Usa Facts History Lessons

Tax Free Retirement Income For Life Guide Retirement Income Tax Free Life Guide

States That Don T Tax Retirement Income Personal Capital

Kiplinger Tax Map Retirement Tax Income Tax

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Investing For Retirement